Top 10 Best Cashback Current Accounts In The UK (September 2024)

Cashback current accounts have continued to grow in popularity in recent years, offering us cashback on our energy bills, every day shopping, commuting costs, and more.

While Santander and NatWest previously stood out from the crowd with their cashback bank account offering, they now have competition from fellow high street banks. Not to mention the launch of digital banks like Chase and Monzo, who have proved popular with millennial and Gen Z bankers.

Personally, I can’t believe I only found out about these types of bank accounts a few years ago! I was absolutely kicking myself when I found out I could get cashback from a bank account.

So, what are cashback current accounts and which are the best ones on offer currently in the UK?

What are cashback current accounts?

Cashback currents accounts work the same as regular current accounts, but they reward you with a cash bonus incentive when you spend with popular retailers like Argos or Tesco. You can also get cashback when you set up direct debits for household bills, including utilities and mobile phone contracts.

Each account offers different perks and percentages, and some also charge a fee. Most cashback accounts have fixed terms and conditions, and they might charge you a fee if you don’t pay in a minimum amount each month.

Others only reward cashback with specific retailers, or have a maximum amount of cashback you can earn each month. So it’s worth weighing up how much you spend day to day and considering if a cashback current account is right for you.

How do cashback accounts work?

Cashback current accounts typically give you cashback based on the amount you spend. Banks calculate this through your every day debit or credit card transactions, direct debits, and standing orders.

Here are the main types of cashback current accounts and how they work:

1. Get cashback for spending on your debit card

Most cashback current accounts offer a percentage of cashback for spending on your debit or credit card with specific retailers. To activate these rewards, you’ll need to log into your online bank account and select what offers you’d like to add to your account.

After you’ve then spent with these retailers, the cashback will appear on your bank statement shortly after.

2. Make cashback paying your bills

Some cashback accounts offer a percentage of cashback when you set up certain direct debits and standing orders for household bills and expenses. This includes energy bills, council tax, mobile and broadband contracts, and even your mortgage payments.

If you’re switching and you’ve already these set up previously, then your bank should automatically start tracking these and reward you cashback for these types of transactions.

3. Earn cashback when you switch & pay in monthly amounts

Some cashback bank accounts reward you a cash bonus for switching and paying in a minimum monthly amount e.g. £1,000 a month. You may also have to have a minimum of two direct debit transactions going out each month.

How much cashback can I earn?

The amount of cashback you can make depends on what bank you choose to open a cashback current account with and how much you’re spending each month.

Some banks offer cashback on everything, whereas others only offer it on selected products and services. On average, you can expect to earn somewhere between 1% and 15% cashback on transactions.

What are the best current accounts for cashback?

My two personal favourites are definitely Chase and Santander Edge, but I’m always checking to see what the others are offering in comparison. Here are the best cashback current accounts available in the UK…

1. Santander Edge current account

Santander Edge gives you 1% cashback on all supermarket and travel spending, including fuel, train and bus tickets, and electric vehicle charging. You also get 1% cashback on bills, like council tax, mobile and home phone, broadband and TV packages, gas and electricity, and water.

You can earn up to £10 cashback per month for everyday spending, and £10 for your bills, so £20 max total. It costs £3 per month and you have to pay in a minimum amount of £500 and set up at least two direct debits.

If you spend more and fancy upgrading, the Santander Edge Up gives you £15 in each category, so you can get £30 maximum cashback. This costs £5 per month and you must have at least £1,500 coming into the account each month, plus, two direct debits.

Extra perks include £175 free cash when you switch, and a linked 7% easy-access saver account for up to £4,000. (The 7% easy access savings account is only available with an Edge account, not Edge Up.)

2. Chase cashback bank account

Chase offers 1% cashback on most of your spending within your first 12 months. You’ll get a maximum of £15 cashback per month, and the account also comes with no abroad fees, and 1% cashback when you spend abroad.

After your first year, you’ll need to deposit at least £1,500 a month to carry on getting 1% cashback. Exclusions for cashback include art galleries, antique shops, debt repayments, and a few more, which you can look at here.

When you open a Chase bank account, you’ll get a generous 5.1% AER interest on a linked easy-access saver. Plus a bonus of 1% AER until 16th January 2025. There is also a round-up account option, which pays 5% interest. So say for example you spend £1.50, 50p will be transferred to your 5% savers account.

3. TSB Spend & Save Plus account

Open a free TSB Spend & Save account and you can earn £5 cashback every month for the first six months if you make 20 debit card payments each month. They’re currently offering double the amount, so £10 cashback per month until December 2024. Plus, you’ll get £100 for switching. So there is the potential to make £160 here.

The account also offers 2.92% AER Variable savings pot, plus additional rewards like savings on takeaways, holidays and cinema tickets. You even have the opportunity to save when booking in your MOT.

If you upgrade to a Spend & Save Plus account, which costs £3 per month, you’ll keep earning cashback until you close the account.

4. NatWest Reward bank account

A NatWest Reward bank account has a range of cashback perks, including £4 cashback when you set up two or more direct debits for at least £2 each, and pay in £1,250. Plus, £1 when you log into your mobile banking app at least once a month.

You’ll also receive between 1% to 15% cashback when you shop with partner retailers, including Uber Eats, Morrisons, Currys, and loads more. There are more bank accounts available, but the cheapest option is the Reward account with a monthly fee of £2.

5. Halifax Reward current account

With a Halifax Reward current account, you can choose a monthly reward, which is either £5 cashback paid into your account, one cinema ticket, or three digital magazines.

On top of this, you’ll get up to 15% cashback when you spend on your debit card with a range of retailers and websites, like Booking.com, Sainsbury’s, Costa Coffee, to name a few.

There is a £3 monthly fee, but you don’t pay this if you pay in at least £1,500 a month. Or you can pay £3 and spend £500 on your debit card or keep £5,000 in your account to qualify for your reward.

You’ll also get access to a Reward Bonus Saver – 4.00% AER, or ISA Reward Bonus Saver – 4.00%, plus better travel money rates, and even more perks with your Reward account.

6. RBS Reward bank account

Royal Bank of Scotland (RBS) offer £4 cashback a month with a Reward bank account, plus £1 when you log into the mobile app.

You can also earn 1% in cashback when you spend with their partner retailers. You’ll need to have a minimum of two direct debits set up for at least £2, and have at least £1,250 coming into your account each month.

As you can probably tell from the branding, RBS is basically the same as NatWest, but I wanted to include it on this list, as I know some people have loyalties towards certain banks and you might just prefer RBS.

7. Barclays Blue Rewards

Barclays offers cashback with their Blue Rewards scheme, which can be added to most Barclays Bank accounts, including a current account. This offers £5 cashback when you set up two active monthly direct debits and pay in £800 each month.

You can also earn up to 15% cashback from participating retailers like Boohoo and Domino’s when you use your Visa debit card linked to your Blue Rewards account. The monthly fee is £5, which seems a little counterproductive, in the sense that you’re getting £5 cashback but it costs you £5 to run the account.

You can, however, earn cashback through other Barclays products. You currently get £3 a month for a mortgage, £5 for life insurance with critical illness cover, £1.50 for standard life insurance, and £1 a month for a personal loan.

They have just released a statement announcing they’re giving their Blue Rewards scheme a refresh in September 2024. So stay tuned!

8. Lloyds Everyday Offers

Lloyds Everyday Offers rewards Lloyds current account holders with up to 15% cashback when you shop with selected retailers. You have to log into your online banking account and manually activate each offer that takes your fancy.

There isn’t any monthly fee to this one, you just need to hold a Lloyds Bank account and spend on a debit / credit card so they can track your purchase and reward you cashback each month.

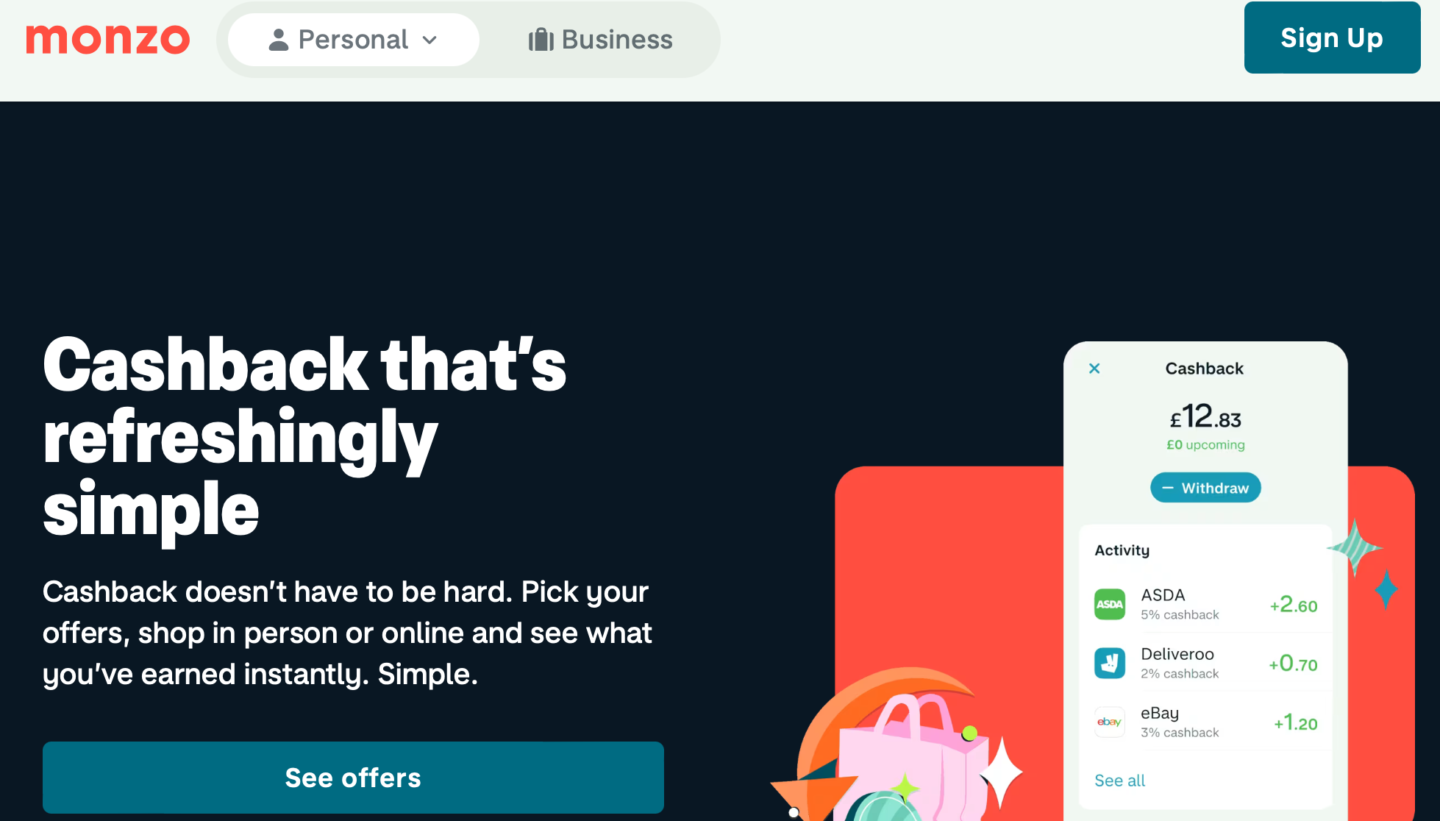

9. Monzo cashback

Monzo allows you to earn cashback with retailers when you spend with your Monzo card. You can generally get between 2% and 10% cashback for retailers like ASDA, H&M, eBay, Deliveroo and loads more.

Cashback works across all your Monzo accounts, including personal, Plus, Premium, joint, and Flex credit card accounts. It also tracks if you pay with Apple Pay and Google Pay too. If you’re a new Monzo customer, sign up using my link and you’ll get a £5 bonus if you spend on your Monzo card within 30 days of signing up.

10. Virgin Money cashback

Virgin Money also offers cashback across its current accounts and credit cards when you shop with various brands and websites. This includes travel companies like LNER and Virgin Voyages. You can also get cashback on entertainment such as theatre tickets at The Ambassador Theatre (ATG).

Once you’ve earned some cashback, you can choose whether to add it to your bank account or trade it in for an e-gift card for a range of retailers.

Pros & cons of cashback current accounts

Like everything, cashback current accounts have their advantages and disadvantages:

Pros

- You earn money on things you’re buying every day anyway

- Double the savings with some accounts that offer cashback on monthly bills

- Get exclusive benefits with cashback accounts, such as increased savings interest rates

- Even with account fees, you’ll always end up better off

Cons

- Some have account fees, meaning you end up with less cash

- You’ll most likely get a better cashback rate with a regular bank account

- Banks may increase fees or reduce your cashback rates over time

- They’re not suitable if you need an overdraft

Do you pay tax on cashback on a current account?

Cashback is typically treated like a discount on a product, and in most cases you won’t need to pay tax on cashback rewards. However, you might need to pay tax on cashback if the payments continue for longer than a year and you don’t pay a fee for your current account.

If you do pay a monthly fee for your account, the cashback should automatically be taxed at 20% by your bank before you even receive any payment. It also depends on your personal tax-free allowance. If the cashback you receive pushes you over the threshold, you might need to pay tax on it.

Find out everything you need to know in my guide about cashback and tax in the UK.

Is my money safe in a cashback current account?

Yes, your money is safe in a cashback current account. All accounts on this list are authorised and regulated by the Financial Conduct Authority (FCA) so your money is protected.

When is cashback paid into my account?

Banks generally pay cashback into your account before the last working day of the month following when you redeemed your cashback offer. So say for example, you used a cashback offer or claimed cashback on bills in January, your cashback will be paid into your account by the end of February.

Are cashback current accounts worth it?

I think cashback bank accounts are definitely worth it. Especially with so many of them offering extra cash rewards for switching. And if you think about it, you’re already purchasing things and paying your bills anyway. So you might as well get a little cash bonus, right?

Personally, I would go for a Chase or Santander Edge if you’re looking at switching to any of them on this list. It’s worth reading up on them all though and figuring out which one is best for your circumstances. Also, don’t forget to sign up to cashback sites like TopCashback and Quidco, and cashback apps like Airtime Rewards and Cheddar to double up your cashback!

Save this post for later…

Collette is a self-confessed cashback geek, who knows everything there is to know about cashback. She’s saved thousands of pounds through using cashback sites and apps, and is passionate about helping others do the same.