Have you heard of Quidco? It’s the UK’s highest-paying cashback site and a great way to save money when you shop online.

As you’ve probably guessed by the name of my blog, I’m a BIG fan of cashback sites, and cashback apps, and Quidco is definitely one of my favourites. But how does it work? And how much can you make using the site? Keep reading to find out everything you need to know…

What is Quidco?

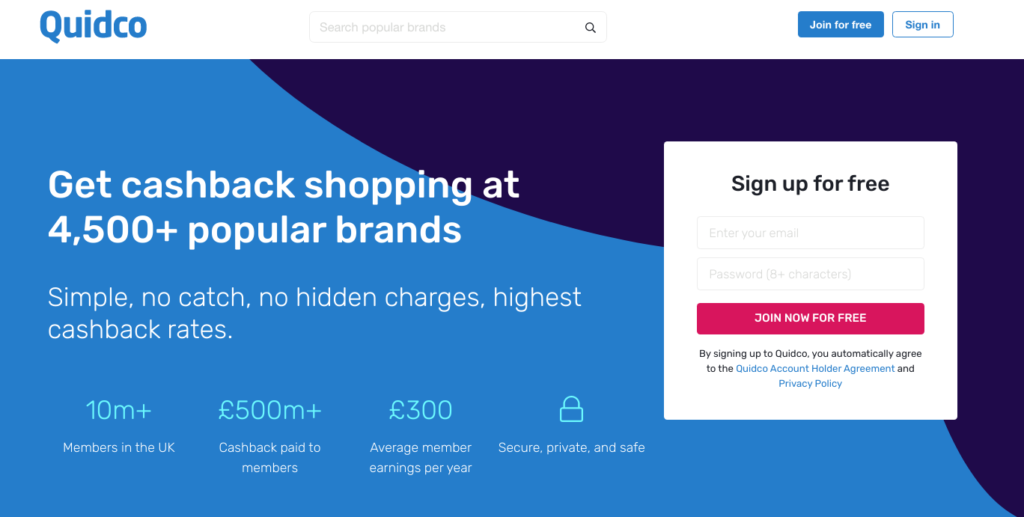

Quidco is a cashback site that helps over 10 million of UK users like you and I make money back on our purchases every time we shop. They work with over 4,500 retail partners to help you get cashback on pretty much anything from clothes, to makeup, dog food, travel plans, insurance, broadband and mobile contracts, and everything in between.

How does it work?

Quidco is super user friendly and it’s really easy to start getting cashback. Here is a step by step guide on how to use the website:

Step 1: Create a free account

To get started, sign up for an account using this link and you’ll get a FREE £15 bonus when you earn your first £5 in cashback. It only takes a couple of minutes to sign up and you should receive a welcome email explaining the basics.

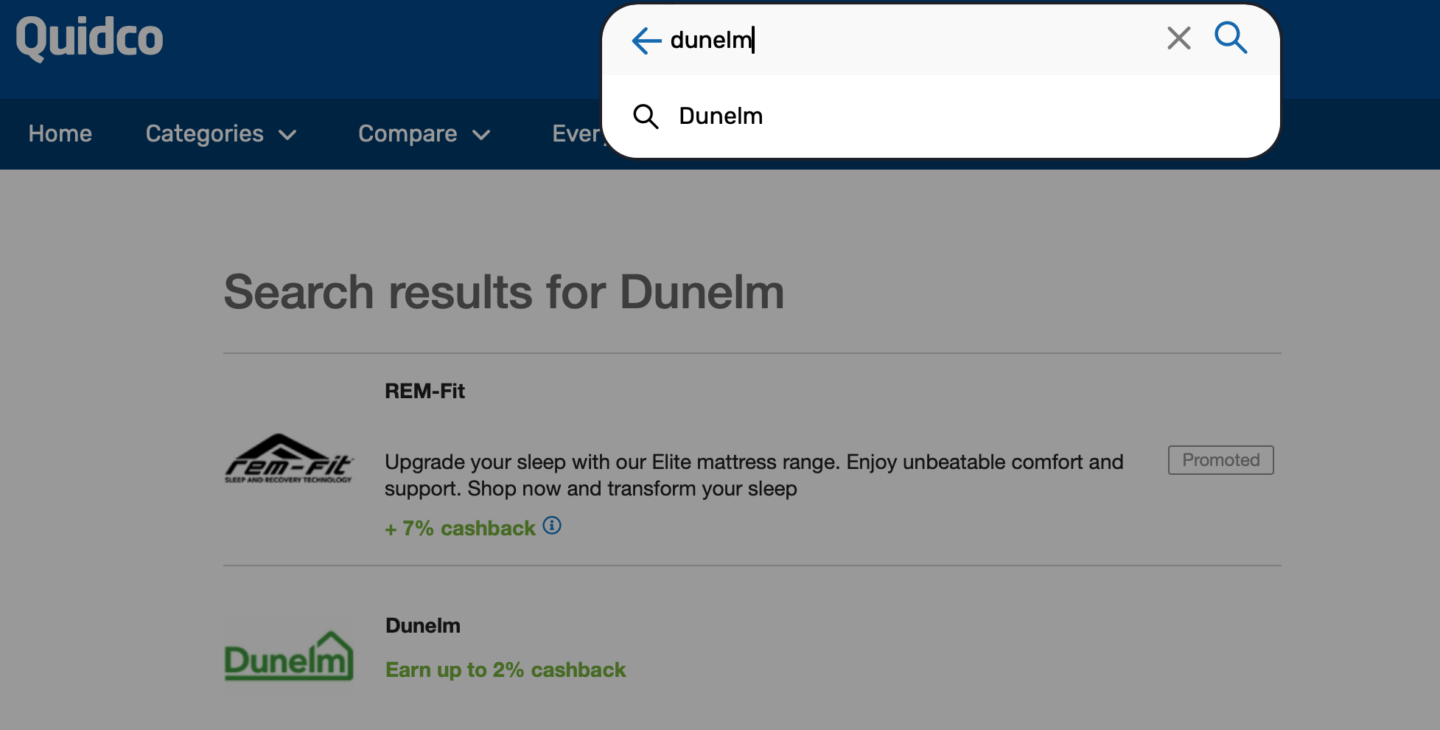

Step 2: Search for a retailer

After you’ve set up your account, simply log into Quidco and search for the retailer you’d like to shop with in the top search bar. In this example, we’ll use Dunelm, as it’s the last place I got cashback from on Quidco. (I spend way too much money on home accessories!)

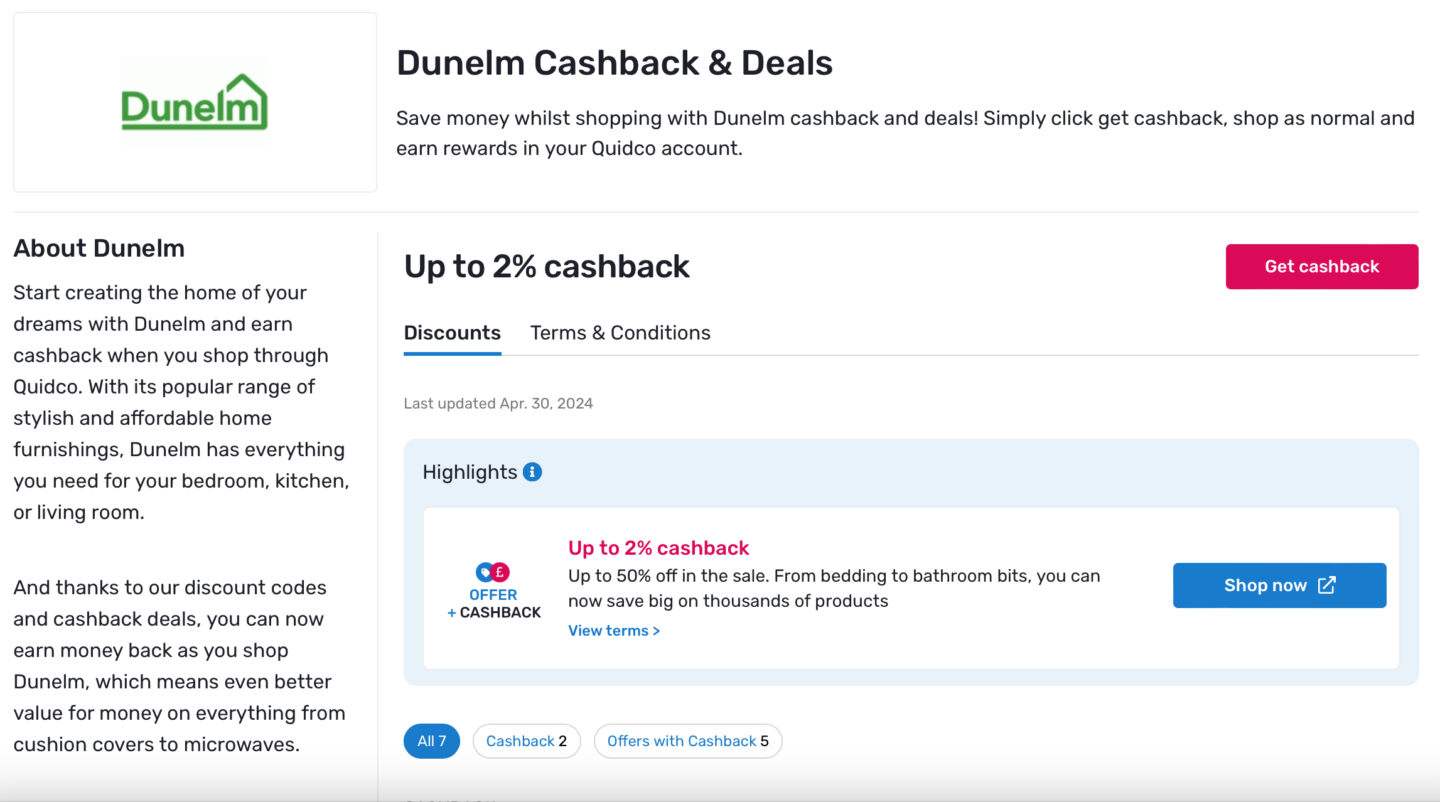

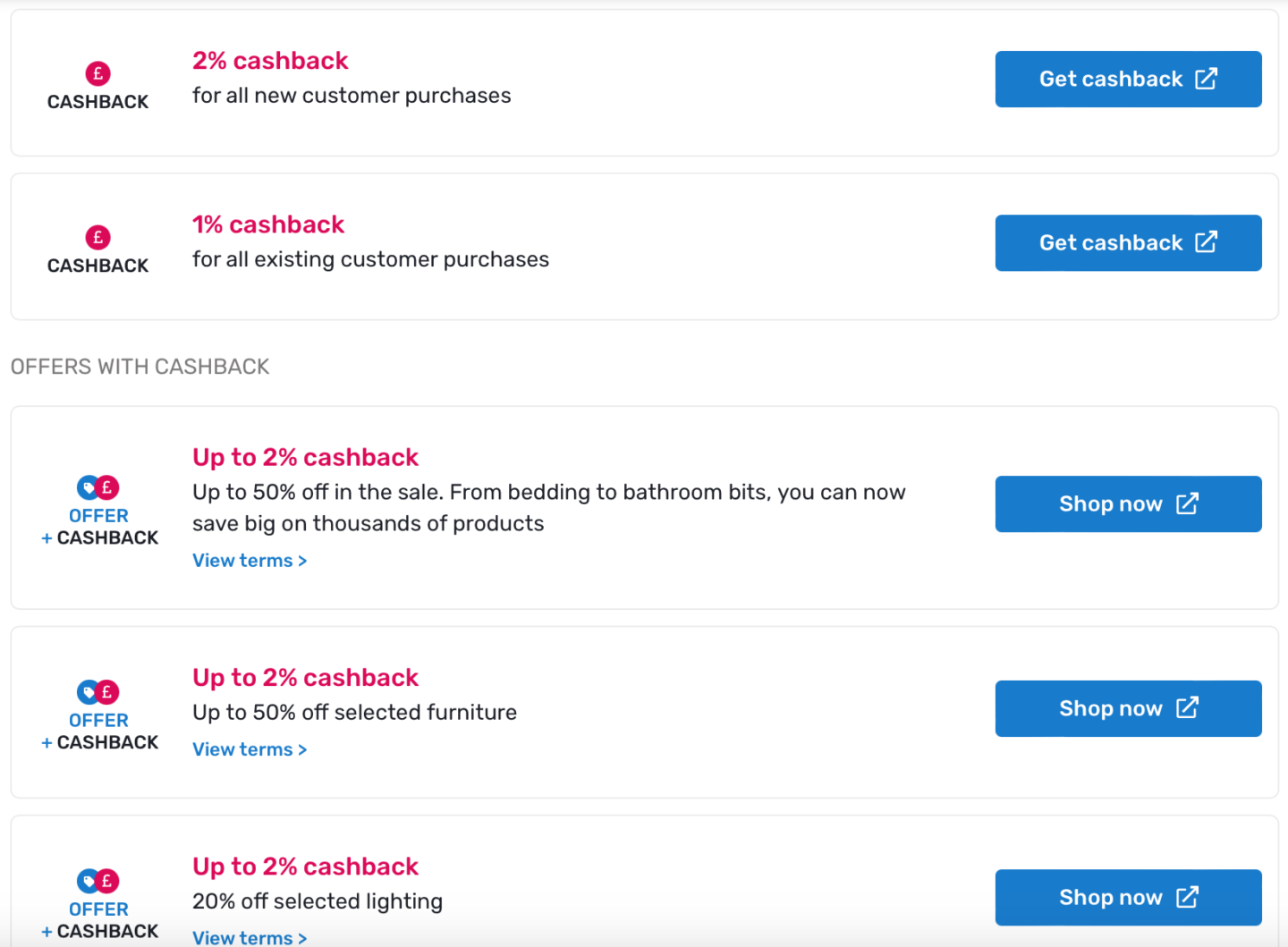

Click on Dunelm and you’ll see the retailer page. This will have some information about the brand, plus cashback rates available. There may be a list of various cashback rates on certain products e.g. 2% cashback on bedding and curtains, and 1% on all other purchases. It all depends on what promotions are running when you shop.

I find that it doesn’t matter too much if you click the wrong promotion, but in general, I usually just click the main pink ‘get cashback’ button at the top of the retailer page.

Step 3: Make a purchase

Clicking a ‘get cashback’ or ‘shop now’ button on a Quidco retailer page will redirect you to the retailer page. In this case, you’ll land on Dunelm’s website homepage. Shop and check out as normal, and you should receive a confirmation email from Quidco to say they’ve tracked your purchase.

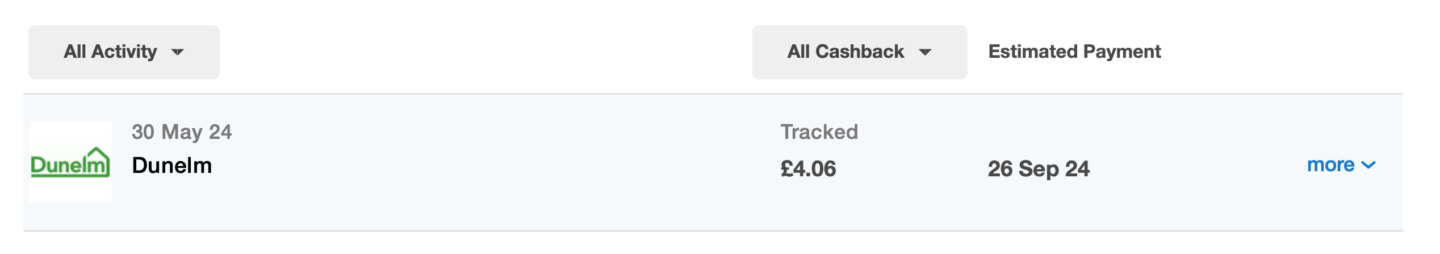

It will then appear on your Quidco account and give you an indication of when you can expect to get paid:

Step 4: Wait for your cashback to be confirmed

Keep checking your account and once it’s confirmed, you can cash out. Here is what confirmed cashback will look like on your statement:

Some transactions take just a couple of weeks to confirm, e.g. a Domino’s takeaway will pay out quite quickly. More significant purchases, such as an insurance policy from MoneySuperMarket, may take months to confirm.

Step 5: Withdraw your money

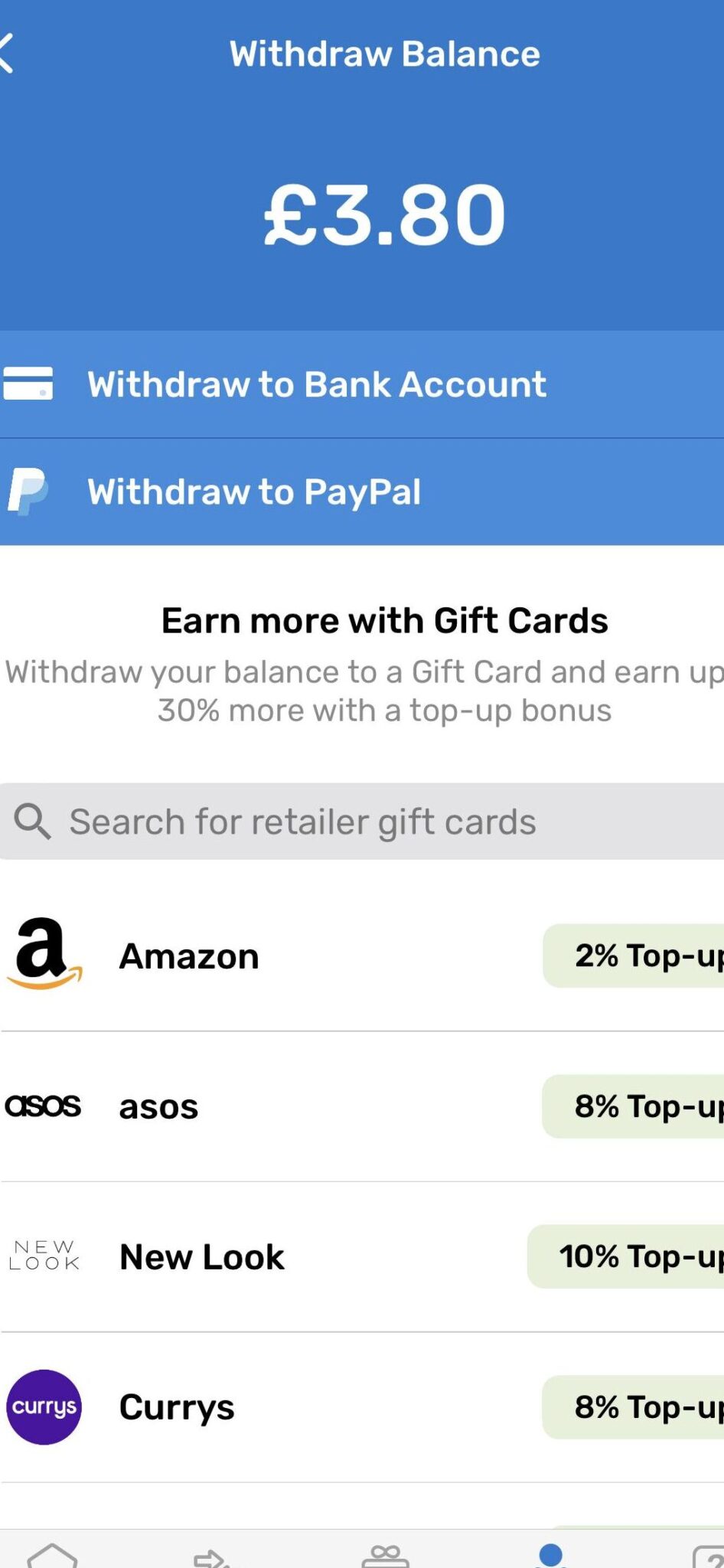

Once your cashback has been confirmed, you can withdraw it via your PayPal or Bank account. If this is your first time cashing out, you’ll need to add your details to your account settings, which only takes a minute.

Head to your profile by clicking on the person icon in the top right of your screen. Then, click tracked cashback and it will show you all your transactions. Click on ‘withdraw’ on the left hand menu and follow the instructions to cash out.

You can also use Quidco the same way on your phone by downloading their free app and earn cashback on the go. Withdrawing your balance is also an option on the app too.

If you choose to exchange your earnings for a gift card for a range of retailers like Amazon, Primark, or Costa, Quidco will actually give you a top up payout bonus of up to 25%.

Is Quidco free?

Yes. Quidco is 100% free to use for all users. Even if you sign up for a Premium membership, they deduct the cost out of your cashback earnings, rather than charge you a fee.

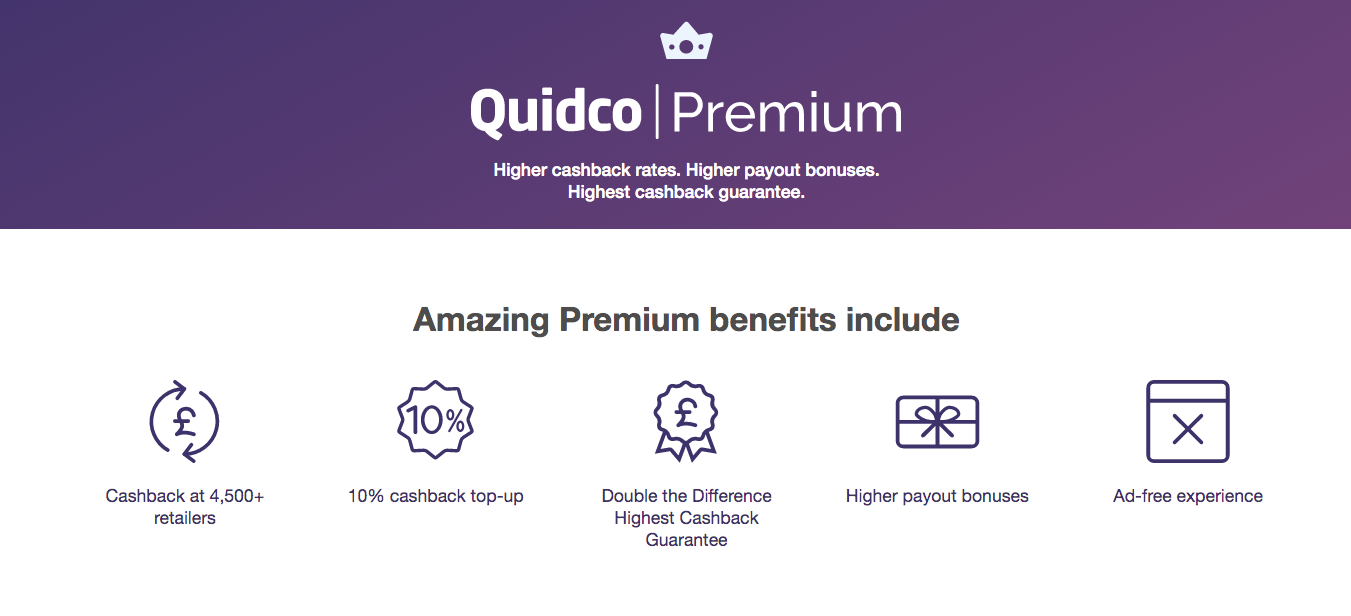

What is Quidco Premium?

Quidco has two account options: Quidco Basic and Quidco Premium. If you upgrade to a premium membership, you’ll unlock these amazing benefits:

- Cashback at 4,500+ retailers

- Up to 10% top-up on cashback rates

- Double the Difference Highest Cashback Guarantee

- Up to 20% payout bonuses

- An ad-free experience

Once you’ve joined, Quidco keeps £1 of your cashback per month as a fee for the membership. They will never take this money from your bank account.

They will only retain this fee for the months that you are active on your account. If you haven’t made any transactions in the previous 30 days, you won’t be charged for that period of time.

How much can I earn using Quidco?

Quidco states that their average user earns £300 a year, which is nothing to be sniffed at! Especially if this is from purchases you’re making anyway. How much you earn all depends on how often you’re using the site, and what you’re purchasing. It will also depend on the promotions running at that point in time.

If you check the cashback rates available on each retailer page, it will give you a good idea of how much you can earn before shopping.

Is Quidco safe to use?

Absolutely! I’ve used it myself for a long time and have never had any problems receiving my cashback. If you have any concerns, you can contact their super-friendly customer service team on the website. They recently installed a customer service Bot, who can help with basic queries too.

How long does it take for cashback to show on my account?

Before you make a purchase, you can see how long it will take for your cashback to track on each Quidco retailer page under the ‘cashback details’ tab. Once your purchase has been made, your cashback will need to be approved by the retailer. This can take 3-6 months on average, but might be even longer.

I know it sounds like a long time, but if you’re constantly using the site, you’ll always have a flow of cashback payable on your account throughout the year.

What is the Quidco Highest Cashback Guarantee?

Quidco offer a highest cashback guarantee, which means they’ll match any rate you get from another cashback site, and add a little extra on top. If you’re making a claim, this must be submitted within

72 hours of you purchasing your item, and you must provide valid evidence for Quidco to honour their guarantee.

How long does it take for Quidco to pay me?

Once you’ve submitted your withdrawal request, Quidco says it can take up to 6 working days for the payment to reach your account.

They’re usually really good and send email updates at every step of the process, so you’ll know when the cashback is on its way to your account.

Can you use Quidco in-store?

Unfortunately, no, you can’t use Quidco in-store. They used to have an in-store section, similar to TopCashback, where you could connect your card and activate selected offers, but they’ve now removed this from their site.

They also used to run an app called Quidco ClickSnap – a supermarket cashback app where you could get cashback on a range of supermarket products by uploading a photo of your receipt. But they also recently turned this off.

Tips & tricks to earn more on Quidco

There are a few ways you can maximise your earnings. Here are my favourite ways to boost my cashback:

- Get a £15 welcome bonus – when you earn your first £5 in cashback using this link

- Opt in for a Premium membership – I’ve earned loads more cashback since getting better cashback deals and you can’t really argue with them taking £1 out of your cashback pot in exchange for much higher rates!

- Cashout as a gift card – you’ll get a higher percentage amount on withdrawing your cashback as a gift card than you would via PayPal or BACS

- Download their cashback reminder extension: this sits in your browser and pops up every time you land on a website offering cashback. Download it for free here

- Get involved in competitions & games – the site hosts loads of competitions and boosted cashback days throughout the year, where you can earn big cash prizes – the last one I saw was to win £10k cash!

- Deal stack using voucher codes – Quidco also offers exclusive voucher codes so make sure you check these out on each retailer landing page!

- Refer your friends – you can earn £15 for every friend you refer!

Do I need to declare Quidco cashback as income?

No, cashback rewards on spending are not taxable. Therefore, you do not need to declare these earnings as a form of income.

Is Quidco worth it?

I would say it’s definitely worth using Quidco! I always recommend using cashback sites and apps, especially if you were going to purchase a product or service anyway. You might as well get a little cash bonus for doing so. It’s so easy to use and takes minimal effort. So I would say yes, Quidco is 100% worth it.

Pin for later…