You can get cashback on just about anything you buy. From every day purchases like clothes and beauty products, to more significant investments such as an insurance policy or stocks and shares. You can even get cashback on your mortgage.

But what exactly is cashback? Keep reading to find out everything you need to know…

What is cashback and how does it work?

Cashback is a cash incentive that brands offer you as a consumer to encourage you to buy their product or service. When you purchase said product or service, you earn a cash bonus back. This could be a percentage e.g. 5% or fixed amount e.g. £5.

Ways to earn cashback

There are various ways to earn cashback on your purchases, and they all work slightly differently:

Through a cashback site

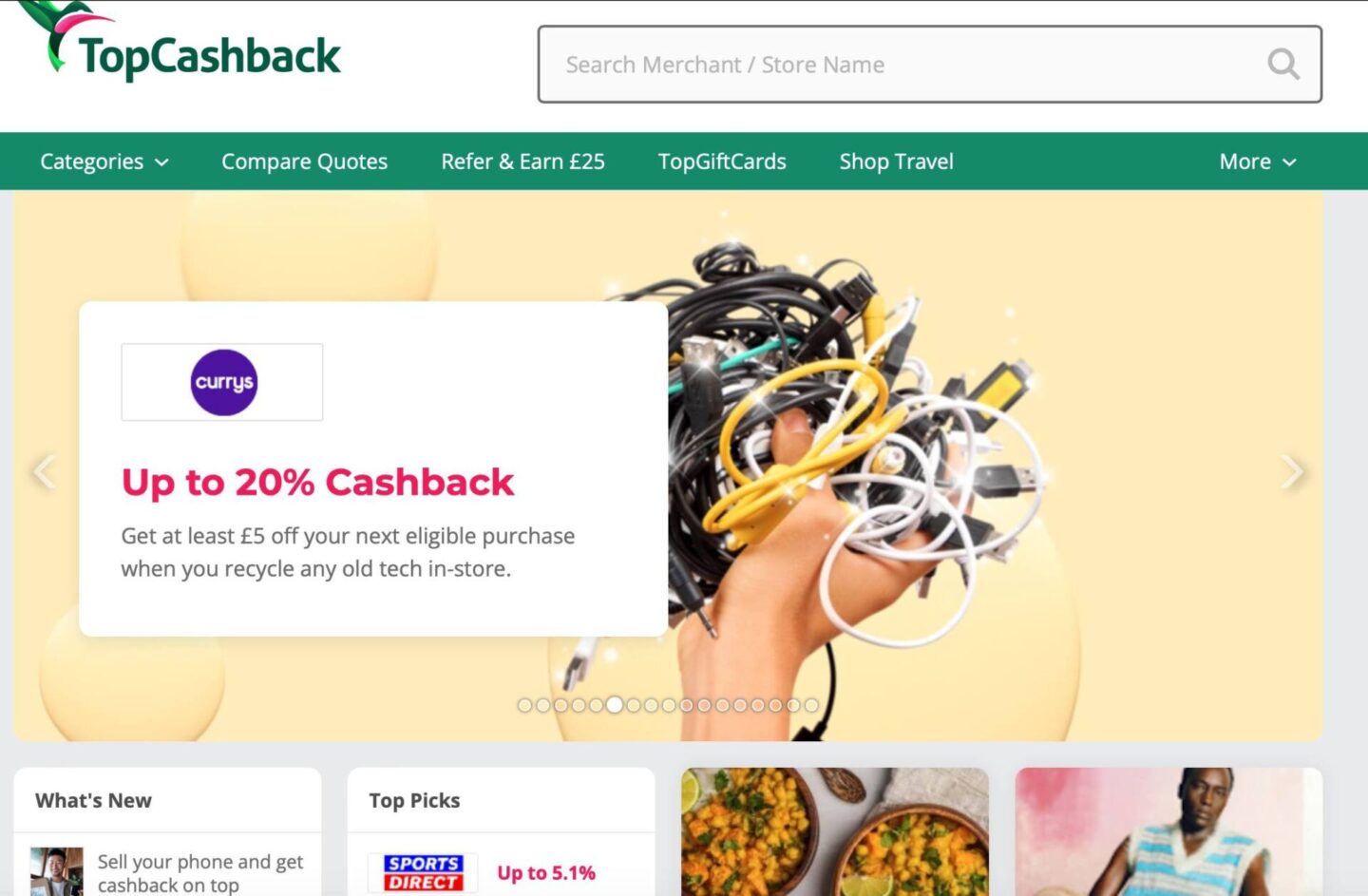

Cashback sites such as TopCashback and Quidco make money for advertising thousands of brands on their website. Whenever you shop with one of these brands, the cashback site earns a commission from the retailer, which they share with you.

Sign up for a free account and search for your favourite retailers on the cashback site, click through and shop as normal, and once you’ve checked out, the cashback will be added to your account.

As soon as your purchase and cashback has been confirmed by the retailer, you can withdraw the money into your PayPal or bank account. You also have the option to cashout as a gift card for a number of popular high street and online retailers such as Costa, Primark, or Amazon.

The time it takes for the cashback to reach your account varies based on when the retailer confirms your purchase and pays the cashback site. It often gives you an expected timeframe on each retailer page, along with the cashback percentage rate. This also differs per retailer, and can often be anywhere from 1% up to around 10%.

Get cashback on an app

Supermarket cashback apps like Shopmium, GreenJinn, and CheckoutSmart are all free to use. Each offers cashback deals on certain products, available in a number of UK supermarkets.

You purchase the product as normal, upload a photo of your receipt, and they’ll reward you cashback. The rate of cashback you can receive varies. Sometimes you get products 100% free.

Airtime Rewards is another popular cashback app, which offers money off your phone bill when you connect your card via the app and shop in-store and online with selected retailers.

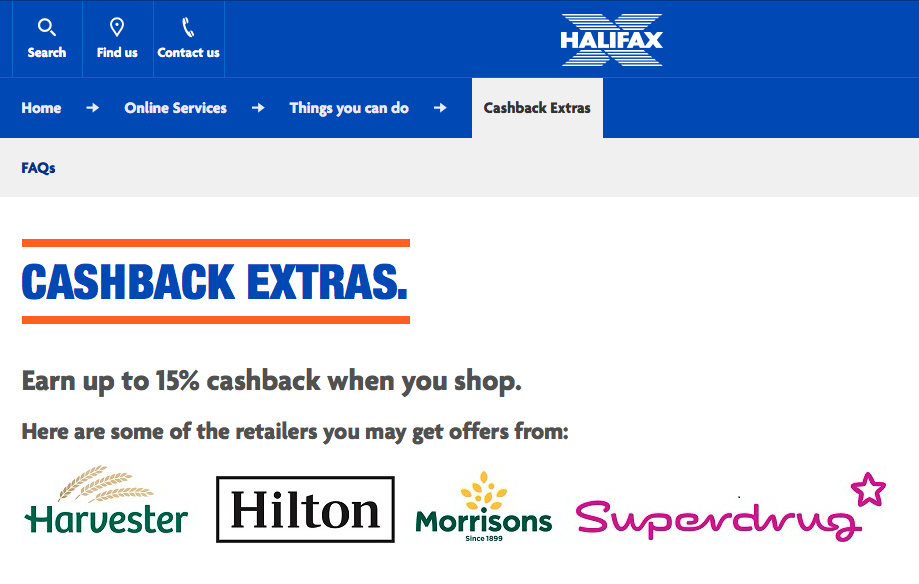

Get cashback with your bank

You can also earn cashback with your bank when you spend on your debit card associated with your bank account. Banks such as RBS, Barclays, Halifax, Lloyds, and Santander all offer customers cashback incentives. Some require you to log in and activate the rewards.

It’s worth doing some research on this, as cashback rates depend on what type of account you hold with your bank. Some offer cashback offers to all bank account users, while others reserve rewards for customers who pay a monthly rate for their bank account.

Use a cashback credit card

Cashback credit cards offer a cash percentage (e.g. 1% cashback on all purchases) or reward points based on what you spend on your credit card.

These types of credit cards only really make financial sense if you’re paying off the balance each month. Otherwise, you’ll probably end up paying more in interest than what you earn in cashback.

It’s also worth mentioning that the best cashback credit cards with the highest cashback rates may also have annual fees so it’s worth checking before you are tempted in by the amount you may earn in cashback.

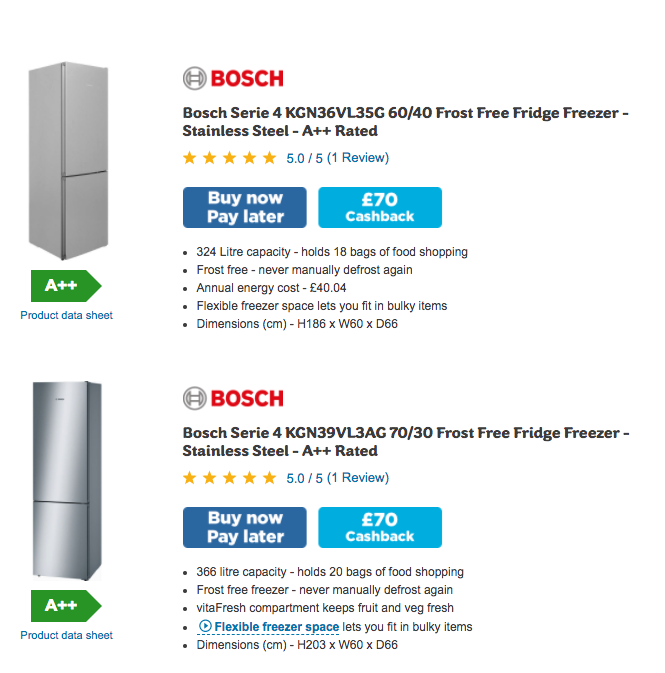

Get cashback directly from a retailer

Various retailers such as AO, BT, and mobiles.co.uk also offer exclusive cashback deals to new and existing customers who shop directly with them. You can often see banners for these deals when you land on their websites, or click on specific products linked with the promotional offer.

What can I earn cashback on?

From car insurance to your weekly shop, the list of what you can earn money back on is pretty much never ending. If it’s something you’re buying, chances are you can get cashback on it.

Some of the most useful things I’ve earned cashback on are:

- Insurance policies

- Broadband and mobile phone contracts

- Holiday deals, hotels, and flights

- Appliances and furniture

- Supermarket shops

- Clothes and makeup

- Takeaways

- Concert tickets

- Gifts and greeting cards

- eBay purchases (great for earning Nectar points, too)

- Using comparison sites like MoneySuperMarket and uSwitch

- Our mortgage with Halifax (£1,000!)

Plus loads more.

How much money can I make?

Some people have made thousands of pounds from cashback sites and apps, myself included. In general, how much you make from cashback will depend on:

- What you’re buying

- How much it costs

- What deals are up for grabs at the time of browsing

Some companies offer a percentage and others offer a fixed fee. Most sites offer anything between 2% – 15% but you can score big cashback offers where you can earn £100 or more. These will often be reserved for bigger purchases, such as insurance, broadband, mortgages, etc.

Cashback pros and cons

As with anything, there are pros and cons to earning cashback, including:

Pros

- Most sites and apps are free to use, with the option to upgrade to premium accounts

- It’s essentially a free cash bonus if you were going to make the purchase anyway

- You can get cashback on a lot of brands and services

- There are cashback browser extensions, which can be installed to pop up when you land on a website with Cashback, so you don’t have to keep remembering to log in and click through the cashback site

- Some sites and apps offer you extra money to refer other users

- Cashback sites now offer voucher codes in addition to cashback, so you can double up on savings for certain retailers

Cons

- It can take a while for your cashback to be confirmed and for the money to reach your bank account

- Cashback deals may not offer the best saving, so it’s best to check for discount codes or coupons too

- Sometimes your cashback doesn’t track or there is a technical error, which is annoying (but easily resolved thanks to helpful customer services teams)

- Cashback offers might not be available for selected retailers

- There are cashback scams that appear as ads on certain websites, so be vigilant when shopping online

Is it worth getting cashback?

I would say it is definitely worth getting cashback. It’s definitely helped me save money over the years. It takes minimal effort and as I mentioned, it’s basically a free cash incentive if you were going to make the purchase anyway.

Save for later…