Last year our money-saving abilities were really put to the test when we decided to get our foot on the property ladder and purchase our first property, that’s right, we wanted to try and save money for a house while renting.

Were we mad? Potentially. We were far away from home so moving back in parents wasn’t an option.

So we had to find ways to cut our budget and save enough for a deposit while renting.

How did we do it?

Before I get into it, a bit of background on our situation…

In 2016 my partner and I moved across the country from our hometown in Manchester to Surrey.

I love it here but moving to the other end of the country was a big challenge for both of us.

Moving down South was a huge change of lifestyle in so many ways.

The culture shock for me wasn’t the people or the crowds or anything like that.

It was how expensive everything was!

This was very apparent when we started looking at properties.

Our first property

In June 2017 we bought our one-bedroom flat! We thought it was a great little investment and a good first step onto the property ladder.

As a fixer-upper, it’s also taught us A LOT about DIY and the responsibilities of owning our own home, etc.

Here are my top tips to help you save for a house EVEN if you’re forking out rent each month.

Break it down

It can seem really daunting when you think about saving a hefty deposit for a house. After all, it’s probably one of the most expensive and important purchases you’ll ever make!

Say you’re looking at a £225k property (Average property price in the UK), it might feel impossible to save £22.5k deposit.

But did you know you don’t have to save 10%? You can look at aiming towards a 5% deposit instead.

So all of a sudden you’ve halved your deposit goal to £11,200 plus legal fees etc. If you’re saving as a couple, that’s £5,600 each.

If you’re trying to save 10-20% of your wage each month, you’ll soon start to rack that up in savings!

Once you have a house price and deposit size in mind, there are loads of mortgage calculators online to figure out important figures like interest and repayments. This will help you suss out what you can afford.

Give yourself a weekly, monthly AND annual budget

Now it’s time to get serious!

Before you start trying to save for a house, grab a brew and sit down for half an hour with yourself or your other half and really hash out your finances.

Write down all your outgoings versus your income and figure out a reasonable budget and then how much you have left to save.

- A weekly budget – all fine for everyday things like food shopping, etc.

- A monthly budget – is better for bills and regular fixed expenses, but also those unexpected costs that might pop up like your car tyre might need changing or the oven breaks

- An annual budget – this one is in my books the most important but the one people forget!

The reason I suggest all three is this.

An annual budget is better because it helps you plan for the whole year.

How can you possibly have the same budget for each month when you have something different crop up every month??

If you make a strict and fixed monthly budget, what happens when you have:

- Christmas

- Birthdays

- Weddings

- Holidays

- MOT

- Insurance renewals

An annual budget can help you map out the months where you might need more money and plan so you’re not leaving yourself short.

Obviously, you’ll have last minute things that come out of nowhere, but it can help you feel more in control if you have some sort of rough plan of your year.

Cancel your direct debits

Did you know that some companies don’t always cancel your direct debits?

This means you could still be paying for phone contracts, gym memberships and electricity bills from years ago – gasp!

They’re under no obligation to pay the money back to you either!

Keep on top of your direct debits by logging into your bank account and going through your list of outgoings every now and again just to check nothing slips through the net.

It’s good to do this anyway, but especially if you’re trying to save for a house.

Switch your bank account & earn more

You can earn up to a whopping £150 when you switch your bank account, which can really help you start or boost your savings.

Plus, some bank accounts offer even more!

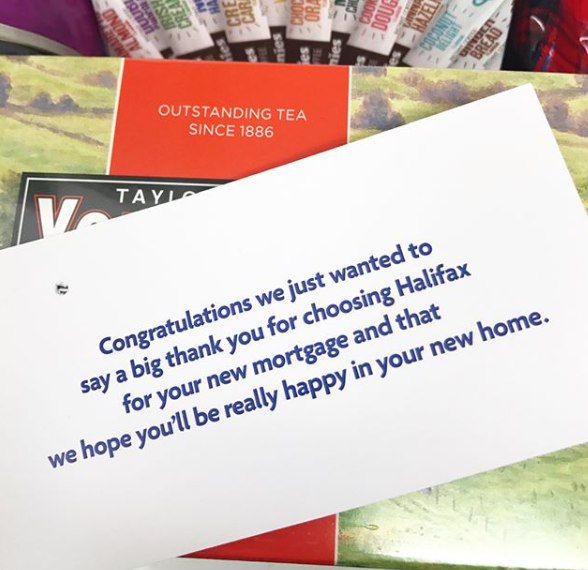

Halifax, for example, offers £3 per month when you pop in £750, which doesn’t sound like a lot but it all adds up!

M&S also gives you a £125 gift card for joining their bank and you can earn £5 extra every month you put in their minimum amount and stay for 12 months.

Rewards come in all shapes and sizes so it’s definitely worth looking into!

Check out this helpful current account rewards comparison guide from Money Saving Expert to help you switch and save today.

Save money for a house with the right accounts

We didn’t take advantage of any ISA accounts available to us because we wanted to get on the property ladder ASAP and found our perfect property quite soon after looking.

We were very lucky that we could cover our expenses etc. with our existing savings, but if we had more time, I definitely would have signed up for one of these!

What savings account should I choose for saving money for a house?

There are two main accounts that you can save into, either a Help to buy ISA or Lifetime Isa (LISA) – they both have their benefits, so it’s up to you which one you go with.

While most people opt for a help to buy, you might find a LISA could be a better option, because you can save up to £4,000 a year and put in lump sums, whereas a help to buy you can only save £2,400 (£3,400 in your first year)

You can only use one to buy a house and the government offers 25% bonuses on either.

If you’ve got a partner, you both need to set up an account to leverage the amount of deposit you can save.

Don’t give up life’s little luxuries to save money for a house

You’re probably thinking what?!?! You’re supposed to be saving money not spending!

I wanted to include this point quite early on because when you’re trying to save for a home, especially while renting, it can quickly become draining and stressful.

You’ll find a lot of articles online telling you to give up coffees, takeaways, eating out etc.

Yeah, this would save you money, but where’s the fun in getting a house when you can’t afford to live and do the things you actually enjoy?

I’m not going to lie and say we gave up these things, because we definitely didn’t! I think it’s important to treat yourself to some little luxuries and not suck the life out of saving.

Instead, we looked for ways to save on the things we already did.

George and I both have pretty hectic lives and we’re so busy doing all sorts of things in the week.

So whenever we get the chance, we love to grab those little moments where we can go for a coffee or a meal and have a good natter or have a movie night at the cinema.

So we basically made it a game – how much money could we save on these things?

Take advantage of freebies

Freebies, vouchers, coupons, loyalty schemes. All ways to save money on your existing lifestyle! I’ve claimed so many useful freebies from makeup, toiletries like toothpaste and shampoo, to meals out and food from the supermarket.

I’ve saved thousands over the years!

The best part is, anyone can claim these freebies. You just need to know where to look.

Check out these posts to help you get started:

30+ best freebie sites to find free stuff

How to get freebies in the post every day

60+ popular places to get exciting birthday freebies

30+ product testing opportunities to get free stuff

20+ high street brands that reward you for recycling

Get cashback on everything

Cashback sites are amazing! You can earn free money every time you shop, but also on bigger purchases like insurance and even on your mortgage! My two favourite sites are Topcashback and Quidco.

You can also save money on your supermarket shop with supermarket cashback apps like Shopmium & CheckoutSmart, which also offer fab freebies and discounts on all your favourite brands.

3. Never pay full price

‘Never pay full price’ is every bargain hunter’s mantra and it should be yours too!

Things like this:

- Buying a dress in a shop without looking online first for exclusive sales, voucher codes, or cashback

- Not waiting 5 minutes until the yellow sticker labels go on packaging in the supermarket (don’t lurk for hours like a weirdo though!)

- Staying with the same energy supplier, broadband provider, phone network because it’s ‘easier’ than switching

ALL big no-nos in the land of money saving!

You can save money on every aspect of your life, like bills, your supermarket shop and loads more.

If you’re going to save for a house while renting, you need to adopt this ‘never pay full price’ mantra.

Some sites and apps to help you out:

- uSwitch – helps you get a better deal on things like utilities and phone contracts

- Cashback sites and cashback apps will help you save money when you shop

- Voucher sites like vouchercodes and forums like Hot UK deals

Hustle on your lunch break (and in the evenings & weekends)

If you find that you’ve reached your absolute limit with the amount of money you’re trying to save each month, why not try and make more money?

If you find that you’ve reached your absolute limit with the amount of money you’re trying to save each month, why not try and make more money?

Here are some of my favourite ways to make some extra cash each month.

- Mystery shopping

- Selling on eBay (I enjoyed this one so much I made it my full-time job for a while!)

- Taking surveys

- Being a virtual assistant

- Focus groups

There are loads of other ways but I think these are good to start off with because they’re not too overwhelming and don’t take up too much time if you have a demanding job or a family.

Plus, things like mystery shopping and focus groups are great because you get paid to talk about and do things you already do anyway like eat out at restaurants or pick up items in a shop that you get to keep!

Don’t forget about more traditional methods of making money, like:

- Cleaning people’s houses

- Babysitting

- Dog walking

- Hair & makeup for special occasions like weddings and proms

- Ironing

I know lots of people that have done really well out of some of these and they all pretty much rely on word of mouth, which is still such a popular way for you to get more business!

Declutter for cash

As I mentioned above, it’s good to sell some of your unwanted stuff on eBay to make some extra cash for your house deposit pot.

There are also other ways to sell your unwanted stuff too.

For bigger pieces like furniture or heavy toys, I find Gumtree and Facebook or similar local selling groups.

If you’ve had a really big declutter and are just looking to get rid of stuff quickly, a car boot is a great option.

Just bear in mind that you probably won’t get as much for your items, but people will buy all sorts.

It’s a good way for you to make some quick cash and make space for furniture in your new home!

For top tips on decluttering your home for cash, check out my guide on how to start selling on eBay.

Walk more

When you’re trying to save for a house while renting, every penny counts. So if you can walk to work and save money on transport costs or fuel, walk to work!

I live about a mile away from my local post office, which is where I go to drop off all my eBay parcels, and I try and walk there and back every day.

If it’s not possible to walk the whole way, why not get off a stop (or a couple) early? It will save you money and it’s a great way to get in those steps!

If you download this app, you can earn rewards based on how many steps you take, amazing!

Give yourself time & don’t be too hard on yourself

I think this is a good point to end on. Saving for a house can be really hard!

Especially if you’re doing it alone or still renting.

If you don’t manage to save one month or an unexpected thing pops up, which puts off your plans to buy a house, that’s ok!

Good luck on your mission to save for a house!

Pin for later…